Cross Border Payment, Clearing, and Settlement Systems -Update October 2019

There have been several new developments in Cross Border Payments Solutions landscape.

- Interbank Cross Border Payments

- Retail Cross Border Payments

Interbank Payments

- Ripple

- SWIFT

- SWIFT GPI

- JPMCoin

- IBM Blockchain World Wire {BWW}

RIPPLE

From {https://digital.hbs.edu/platform-digit/submission/ripple-the-disruptor-to-the-forty-years-old-cross-border-payment-system/}

Cross-border payments today are inefficient, expensive and opaque.

The Global Interbank Financial Telecommunication Company (SWIFT) established in 1973 is still the most widely used method to send cross-border payment using the transmission of financial messages via the international SWIFTNet network.

However, the SWIFT financial messages do not hold accounts for its members nor make any form of clearing or settlement. It essentially only sends payment orders which need to be settled by the correspondent account that the institution has with each other. For this reason, each financial institution needs to have a banking relationship to exchange banking transactions.

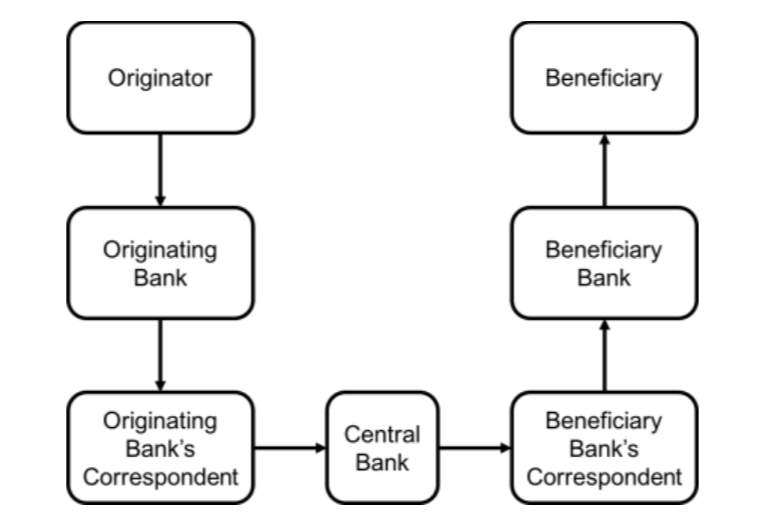

This is why it requires 6 players linked up – payer, payer’s bank, payer’s bank’s correspondent, beneficiary bank’s correspondent, beneficiary bank, beneficiary to complete cross-border payments.

There are many obvious drawbacks of such system:

- Cross-border payments can be expensive and sometimes even charged a percentage fees

- Extra fees such as “lifting fees” or correspondent banking fees by intermediary banks are common

- Bank keep the money for extra time and delay the payout “float money theft”

- Exchange rate can have big spread

The high processing costs, lengthy settlement times and a poor customer experience prevents many new usage scenarios such as on-demand, low-value cross-border payment or mobile wallets. It is estimated that $1.6T per year for all parties in the ecosystem has spent yet unable to meet today’s cross-border payment need[2].

Ripple Labs (formerly OpenCoin) launched in 2012 with a mission to build a cross-border, interbank payment and settlement network using the concepts behind bitcoin. Ripple offers sub-second cross-border payments with automated best pricing from its network. As payments are nearly instant, it helps to remove the credit and liquidity risk from the process, lowering overall costs considerably.

How is it done?

The core of its solution is RippleNet, a single, global network of banks that send and receive payments via Ripple’s distributed financial technology — providing real-time messaging, clearing and settlement of transactions.

RippleNet utilizes a subset of blockchain technology used in bitcoin. It uses the consensual validation of encrypted hashes to secure the messages across the Ripple network but does not hold the ledger, unlike bitcoin. Ripple names this open, neural protocol Interledger Protocol (ILP). ILP allows Ripple to connect existing bank ledgers, similarly to how banks connect their core system to the SWIFT network.

SWIFT GPI

From https://www.bellin.com/blog/swift-gpi-transparent-cross-border-payments/

Challenges in cross-border payments

Cross-border payments usually pass through several banks until the funds have been transferred from the payer to the account of the beneficiary. This is referred to as correspondent banking. This results in four obstacles that are virtually insurmountable for treasurers as things stand today:

1) Time: Traditional cross-border payment orders can take several days from being released to being credited – way too long for efficient cash management.

2) Transparency: Several correspondent banks can act as intermediaries between the bank initiating the payment and the beneficiary bank – an impenetrable banking jungle that causes treasurers sleepless nights for security and compliance reasons.

3) Tracking: Today, treasurers neither know where a specific payment is located nor when it will be credited to the beneficiary – an incalculable business risk and a situation that often leads to time-consuming queries, trying to chase a payment.

4) Remittance data: Remittance data is often altered somewhere along the line or information is lost. Sometimes the amount eventually credited to the account does not match the initial payment order because correspondent banks have deducted fees, resulting in a tedious reconciliation process once the money has arrived.

SWIFT global payments innovation – SWIFT gpi

In January 2017, SWIFT introduced the gpi Service that can be used to process global payments in a fast and traceable manner. The objective is for every one of the around 10,000 SWIFT Network banks to be able to offer money transfers within 24 hours with continuous end-to-end tracking and complete transparency along the entire payment chain by the end of 2020. This transparency and efficiency is made possible by using a specific gpi reference, the Unique End-to-End Transaction Reference UETR.

How the Unique End-to-End Transaction Reference (UETR) works

You can compare the UETR to the tracking number of a parcel: The sender issues a unique, unalterable reference that shows you where the order is located at any one time. This reference ensures complete transparency as well as fully digitized and therefore speedy processing. In addition, the sender is automatically notified of any payment status changes. Conventional transfers often drop off the radar for quite some time, and you’re left wondering where your money has gone, not to mention the effort it will take you to retrace and reconcile afterwards.Conversely, gpi transfers generate an abundance of messages that keep you up to date on the status of your payment.

The same applies to the respective bank departments who can also trace corporate payments, enabling them to react to queries much faster. Some banks have integrated functionality in their online banking applications that enables corporate clients to track their gpi payments. Not a bad idea – the only downside is that most corporates use more than one bank for their international payments, which would mean checking several banking portals. This is why a bank-independent treasury management system such as tm5 is a much more elegant solution. All tracking and status information converges in one centralized hub, no matter how many banks are involved.

SWIFT gpi for Corporates (g4C) – new dynamic and transparency in treasury

In November 2018, SWIFT launched the SWIFT g4C project in order to enable corporates to directly benefit from the gpi technology. The objective was to offer corporates a solution for initiating gpi payment orders directly in their payments system. BELLIN was selected as one of the Early Adopters and was the first TMS provider with a client live on g4C. The pilot phase has been completed and the technology is fully integrated in the tm5 treasury management system and BELLIN’s SWIFT offering.

What does this mean for banks and companies?

The role of banks

Banks must be able to process certain information in order for it to be included in gpi payment orders. More than 280 financial institutions worldwide, including 49 of the TOP 50 banks, have agreed on a standardized SLA. With so many banks participating, communication is guaranteed. i.e. funds are transferred quickly from one bank to the next. By now, most banks have started processing cross-border payments as gpi payments.

The role of companies

The UETR is crucial for processing gpi payments. Companies that initiate their own payments, for example through a treasury management system integrated payment solution need to attach this reference to a payment order in line with SWIFT requirements or extend the format of a payment in the right place to include this information. The information transmitted by way of the UETR simplifies reconciliation and can be matched automatically, depending on the system.

BELLIN offers integrated SWIFT g4C technology

The BELLIN treasury management system, tm5, offers integrated SWIFT gpi technology. The system generates the unique and unalterable tracking reference UETR that is required for gpi payments. In addition, tm5 automatically processes incoming gpi status messages, enabling users to check the status of a payment at any time.

Corporates need a SWIFT BIC (Business Identifier Code) to make use of SWIFT g4C technology. They register their BIC for gpi for Corporates and connect financial institutions that offer g4C. All in all, SWIFT g4C unlocks completely new opportunities for automating treasury processes, in turn leading to efficiency gains and increased security.

How will gpi change treasury?

gpi is fast, creates transparency regarding fees and currencies and provides a wealth of information about the location of a payment and other aspects that simplify reconciliation. The SWIFT gpi initiative is clear evidence that corporate payments are moving towards real-time processing. In turn, this will change processes and the way treasurers work.

Retail Cross Border Payments Systems

Retail Payments/Transfers to India

{From ManiKarthik.com}

- XOOM

- Remitify

- Remitly

- Ria

- Western Union

- State Bank of India

- Transfast

- Transwise

- ICICI Bank Money to India

- WorldRemit

- IndusInd Bank

Block Chain Based Cross Border Payment Systems

- AIRFOX

- CIRCLE PAY

- ZCASH

- RIPPLE

- VEEM

- IVY

- GLUWA

- STELLAR

- ABRA

Top Cross Border Payment Companies

{https://www.ventureradar.com/keyword/Cross%20Border%20Payments}

- Ripple

- Seedrs

- CurrencyFair

- Transferwise

- Payoneer

- WorldRemit

- Trustly Group

- TransferGo

- Raisin

- Zooz

- TransferMate Global Payments

- Calastone

- Airwallex

- Hufsy

- InstaReM

- Caxton

- Veem

- nanoPay

- Credorax

- Transfast

- wyre

- Bitbound GmbH

- Currency Transfer

- Earthport PLC

- Bitso

- WB21

- iSignthis

- Currency Cloud

- BitPay

- MoneyTrans

- Moni

- Traxpay

- Qwikwire

- Streami Inc

- PiP iT

- Swych

- HoneSend

- Afrimarket

- Fonmoney

- Lala World

- Flime

- Smart Token Chain

- TransferTo

- EQ Global

- Weeleo

- SimbaPay

- KUARIX

- REMITWARE Payments

- PingPong

- Buckzy Payments

Please see my related posts:

Cross Border/Offshore Payment and Settlement Systems

Instant, Immediate, Real Time Retail Payment Systems (IIRT-RPS)

Evolving Networks of Regional RTGS Payment and Settlement Systems

Large Value (Wholesale) Payment and Settlement Systems around the Globe

Structure and Evolution of EFT Payment Networks in the USA, India, and China

Next Generation of B2C Retail Payment Systems

Understanding Global OTC Foreign Exchange (FX) Market

Sources of Research:

Ripple wants a piece of the global payment system

https://www.cnbc.com/2019/01/07/ripple-wants-a-piece-of-the-global-payment-system.html

How IBM Blockchain World Wire revolutionizes cross-border payments

IBM

https://www.ibm.com/downloads/cas/YW3W2JPZ

NAVIGATING A WORLD OF PAYMENT SOLUTIONS

WHAT YOU NEED TO KNOW FOR TODAY — AND TOMORROW

George H. Hoffman, CTP, CERTICM, Senior Vice President, Manager, International Advisory, PNC

Kacie V. Johnson, Assistant Vice President, International Advisor, PNC

Click to access navigating-payment-solutions.pdf

Siam Commercial Bank Of Thailand To Use Ripple For Cross-border Payments With Easy Pay App

Siam Commercial Bank Of Thailand To Use Ripple For Cross-border Payments With Easy Pay App

Ripple and Xendpay partner for cross-border payments

https://www.fxcompared.com/magazine/news/ripple-and-xendpay-partner-cross-border-payments

The Future Of Cross-Border Payments

March 2019

Cross-border retail payments

BIS

A vision for the future of cross-border payments

McKinsey

FASTER, CHEAPER, SAFER: 9 COMPANIES USING BLOCKCHAIN PAYMENTS

https://builtin.com/blockchain/blockchain-payments

Global Payments 2020: Transformation and Convergence

BNY Mellon

Click to access global-payments-2020-transformation-and-convergence.pdf

Top 10 Trends in Payments 2018 : What You Need to Know

Cap Gemini 2018

Click to access payments-trends_2018.pdf

Strategies for Improving the U.S. Payment System

Federal Reserve Next Steps in the Payments Improvement Journey

Click to access other20170906a1.pdf

SWIFT gpi: A New Era in Treasury

Fast, transparent, traceable and system-integrated cross-border payments

https://www.bellin.com/blog/swift-gpi-transparent-cross-border-payments/

The Use of RMB in International Transactions:

-Background, Development and Prospect

Click to access pdf-rmb-JinZhongxia.pdf

The Cross-Border Payments Landscape

Click to access 9308A_1-2018-9-17.pdf

Swift to test real-time cross border payments in Europe

https://www.finextra.com/newsarticle/33852/swift-to-test-real-time-cross-border-payments-in-europe

Singtel’s cross-border payments system expands to Japan

The Via cross-border payments system has expanded into Japan thanks to a partnership with Netstars.

https://www.zdnet.com/article/singtels-cross-border-payments-system-expands-to-japan/

THE FUTURE OF CORRESPONDENT BANKINGCROSS BORDER PAYMENTS

RUTH WANDHÖFER

BARBARA CASU

PUBLICATION DATE: 10 OCTOBER 2018

Click to access SIWP-2017-001-The-Future-of-Correspondent-Banking_FINALv2.pdf

How are Asian FIs meeting the challenges and opportunities of cross-border payments?

A Survey on Trends in Cross-Border Payments in Asia Pacific

Click to access TAB_DEUTSCHE_BANK_WHITE_PAPER_-_FI_CROSS_BORDER_PAYMENT.pdf

The Inefficiencies of Cross-Border Payments: How Current Forces Are Shaping the Future

Written by Yoon S. Park, PHD & DBA, George Washington University

VISA

Click to access crossborder.pdf

CROSS-BORDER INTERBANK PAYMENT AND SETTLEMENTS

Emerging opportunities for digital transformation

Click to access Cross-Border-Interbank-Payments-and-Settlements.pdf

Global Payment Systems Survey (GPSS)

https://www.worldbank.org/en/topic/financialinclusion/brief/gpss

Beijing creates its own global financial architecture as a tool for strategic rivalry

Govt of Canada

SWIFT Vs. Ripple — The Importance of Speed in Cross-Border Payments

https://cointelegraph.com/news/swift-vs-ripple-the-importance-of-speed-in-cross-border-payments

Visa looks to speed up cross-border payments with new network launch

Cross-border Payment systems: SWIFT, RippleNet or BWW?

Rise of the yuan: China-based payment settlements jump 80%

Data shows Beijing attracting countries targeted by US sanctions

https://asia.nikkei.com/Business/Markets/Rise-of-the-yuan-China-based-payment-settlements-jump-80

http://www.cips.com.cn/cipsen/7052/7057/index.html

SWIFT’s Battle For International Payments

Forbes

EU Cross Border Payments: An evolving concept

Click to access lu-eu-cross-border-payments.pdf

INTERNATIONAL PAYMENTS IN A DIGITAL WORLD

YET ANOTHER BANKING BUSINESS THREATENED BY DIGITALIZATION

SWIFT gpi Time for action

Deutche Bank

Click to access Deutsche_Bank_SWIFT_gpi_White_Paper_December2017.pdf

B2B Payments and Fintech Guide 2019

Innovations in the Way Businesses Transact

Paying across borders – Can distributed ledgers bring us closer together?

- RODRIGO MEJIA-RICART

- CAMILO TELLEZ

- MARCO NICOLI

MARCH 26, 2019

Reinventing Payments

In An Era of Modernization

Click to access reinventing-payments-in-an-era-of-modernization.pdf

WORLD PAYMENTSREPORT

2018

Click to access World-Payments-Report-2018.pdf

Fundamentals of Global Payment Systems and Practices

Click to access Fundamentals_of_Payment_Systems.pdf

Global Payments 2018

REIMAGINING THE CUSTOMER EXPERIENCE

BCG

Click to access BCG-Global-Payments-2018-Oct-2018_tcm9-205095.pdf

Cross-Border Banking in Europe: Implications for Financial Stability and Macroeconomic Policies

CEPR

Click to access GenevaP223.pdf

Cross-Border Settlement Systems: Blockchain Models Involving Central Bank Money

Xiaohang Zhao, Haici Zhang, Kevin Rutter, Clark Thompson, Clemens Wan

Click to access CrossBorder_Settlement_Central_Bank_Money_R3-1.pdf

One thought on “Cross Border/Offshore Payment, Clearing, and Settlement Systems -Update October 2019”