Slowdown in Global Investment (FDI) Flows

From Determinants of Foreign Direct Investment (FDI)

Foreign direct investment (FDI) is a major component of globalization, together with international trade. Its operation is made possible by movements of factors across countries, in particular, capital. By definition, FDI involves long-term cross-country commitments. According to International Monetary Fund (IMF), FDI entails the establishment of a “lasting interest” by a resident entity of one economy in an enterprise located in another economy (International Monetary Fund, 1993). Lasting interest implies a long-term relationship between the foreign investor and the overseas enterprise where the said investor holds significant influence over management. The IMF defines a direct investment enterprise as one in which a foreign investor holds at least 10% of the ordinary shares or voting power (International Monetary Fund, 1993). The Organization for Economic Cooperation and Development (OECD, 1996, p. 10) classifies enterprises of direct foreign investors into three groups: subsidiaries, in which a nonresident investor holds more than 50% of the ownership; associates, in which a nonresident investor’s shares range between 10 and 50%; and branches, which are unincorporated enterprises owned by a nonresident investor, wholly or jointly. Obviously, such definitions and the resultant measurements leave ambiguities and imprecisions. However, they do help maintain relative consistency in cross-country comparisons.

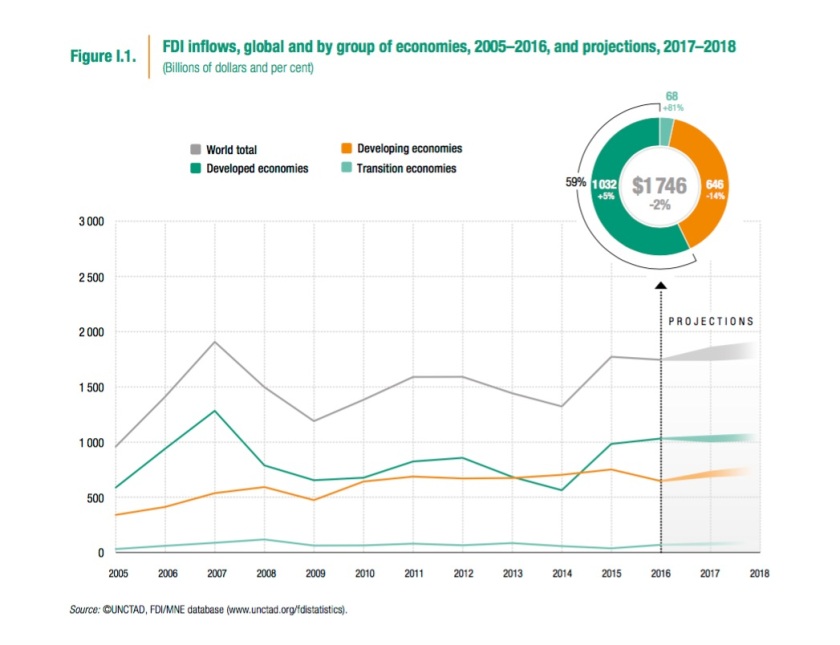

From 1995 to 2015, the world saw a dramatic increase in FDI. The FDI inflows in 2015 were 8.6 times those in 1995, an increase from about 0.2 trillion USD in 1995 to about 1.8 trillion USD in 2015. While FDI inflows to developed countries increased 8.6-fold, those to developing countries and transitional economies increased 23 times. In 1995, FDI inflows to developing and transitional economies were 17% of the world total, and in 2015 they accounted for 45%. FDI flows to OECD countries peaked in 2007, at about 1.3 trillion USD. Between 2013 and 2014, for the first time, developing countries received more FDI than developed countries (UNCTAD, 2016), though the developed world recaptured the position as the largest FDI recipient in 2015 (see Figure 1).

There is an ever-growing body of literature on FDI. As Markusen (2008) demonstrated, three strands of relevant literature exist:

- the international business approach that is oriented toward the rationale of individual firms,

- the macroeconomic approach that focuses on aggregate flows of FDI without making a distinction between direct and portfolio investments,

- and the international trade theory approach, which increasingly moves closer to the international business approach, combining firm-level FDI analysis with aggregate analysis of capital flows.

From UNCTAD World Investment Report 2017

Key Sources of Research:

2017 AT Kearney FDI Confidence Index

http://www.iberglobal.com/files/2017/fdi_index_atkearney.pdf

UNCTAD World Investment Report 2017

http://unctad.org/en/PublicationsLibrary/wir2017_en.pdf

Recent Developments in Trade and Investment

Pierre Sauvé

Trade and Competitiveness Global Practice

World Bank Group

MIKTA Workshop on Trade and Investment

Session 2

Geneva, 20 March 2017

https://www.wto.org/english/forums_e/business_e/pierre_sauve_world_bank.pdf

OECD FDI Data

https://data.oecd.org/fdi/fdi-flows.htm

UNCTAD FDI Data

http://unctad.org/en/Pages/DIAE/FDI%20Statistics/Interactive-database.aspx

GLOBAL FDI FLOWS SLIP IN 2016, MODEST RECOVERY EXPECTED IN 2017

http://unctad.org/en/PublicationsLibrary/webdiaeia2017d1_en.pdf

Cross border mergers make India favoured FDI route: UNCTAD

June 2017

Cross-border M&As push global FDI flows to $1.76 trillion

June 2016

OECD Bilateral FDI Data

http://stats.oecd.org/index.aspx?DataSetCode=FDI_FLOW_PARTNER

UNCTAD Bilateral FDI Data

http://unctad.org/en/Pages/DIAE/FDI%20Statistics/FDI-Statistics-Bilateral.aspx

World Bank FDI Database

https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD

FDI Markets

FDI Reports

Determinants of Foreign Direct Investment (FDI)

Yi Feng

Online Publication Date: Jun 2017